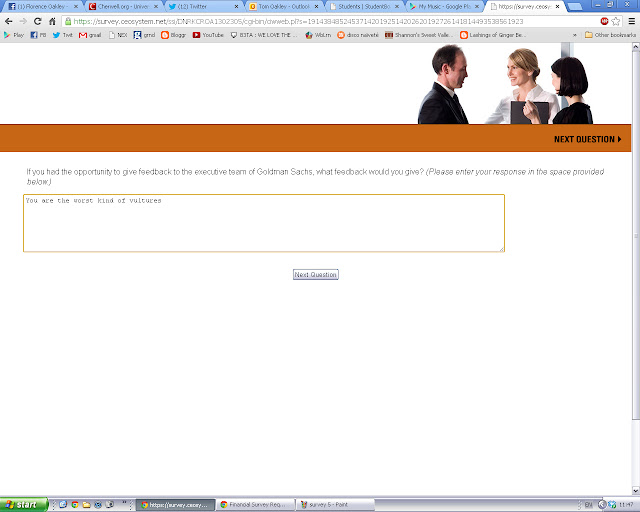

Towards the end I would just skip through surveys as fast as I possibly could, clicking at random like a crazed gunman. However for this latest survey I thought I should be honest. I owed it to them.

Well, we're off to a great start here.

When someone says 'Goldman Sachs', what's the first thing you think of? Ah, of course. Integrity.

Now that you mention it, we really mustn't forget the outstanding contribution from Barclays to our overall economic progress. Maybe not so much these last few years, but on the whole? A fine contribution.

In 2010 the top 95 staff in Goldman Sach's London offices earnt an average of $6.2m. Think how much time you'd want to spend doing your own ironing if your salary was $6.2m. Probably not very much, so just think of all the jobs being created! My only criticism is that none of these firms are paying $6.2m to ALL of their employees - if they did then just think about how many jobs would be created in the ironing sector. In fact there would be so many jobs in ironing that maybe the senior ones could hire new recruits to do their ironing for them. Now wouldn't that contribute to the well-being of society.

Ironing jobs for all.

Trisha: much as I love you, your days are numbered.

As always, my opinion is very important.

Saying 'give us back our money' to the executive team of Barclays shows a fundamental lack of knowledge about the financial sector. Not that it isn't already obvious you have this lack of knowledge, but that's just the cherry on the ignorant cake.

ReplyDeleteI have a vast array of knowledge about the financial sector.

DeleteThe fact that I may have got a bit confused between Barclays and RBS (an easy mistake to make, as both prominently have the letter B in their name) and accidentally suggested that Barclays got a load of our money in a bailout is obviously a minor error.

But thank you for commenting. As always, your opinion is very important.

Two words: LIBOR manipulation.

DeleteSeems you're the one who is ignorant here.

Technically that's 6 words, and LIBOR is an average of 8 banks with outliers removed; any attempt by Barclays to influence it would not have been effective. Therein, they didn't 'take our money' through LIBOR manipulation either. The reason they got fined for it is because it sends a overly-confident signal of economic performance to the markets, which in an asymmetric information market is bad, but because all the banks knew it was happening didn't really have any effect on Barclays' share price. Tl;dr: I'm not ignorant; LIBOR was irrelevant. Tom already admitted he meant RBS, which was clearly the issue. Your opinion is very important though, thank you!

DeleteThere are few things more amusing than people on the interweb confidently stating their case, and not actually realising they are clueless.

DeleteClearly Barclays did not act alone with regards to LIBOR manipulation, however it did actively participate. Given that LIBOR is used as a base rate for setting interest rates on consumer and corporate loans, the manipulation did cost people money.

So yeah, it appears you are indeed rather ignorant of the impact of LIBOR manipulation.

The guy above is butthurt

ReplyDeleteWho the fuck uses Windows XP these days?

ReplyDeleteWindows XP is a fine operating system for those of us who aren't prepared to buy a new computer until the old one is physically dead.

DeleteBut please don't forget - as always, your opinion is very important.

If it runs XP, it'll run Linux. JPIAT

DeleteHow can you say banks do not contribute to overall economic progress. Surely if the financial crises has shown us anything it is how important banks are to the economy? Without those banks how would people get a mortgage? What about lending to small and medium sized companies? Although not relevant to GS it is to both Barclays and DB.

ReplyDelete